REALOGIS: Take-up up of 22 per cent in Hamburg’s logistics and industrial real estate market on course for

recovery in 2025* 335,000 m² take-up

* Rental level largely stable

* Logistics/freight forwarding sector

with the highest demand* The south of Hamburg was the regional focus

* Strong demand for existing space

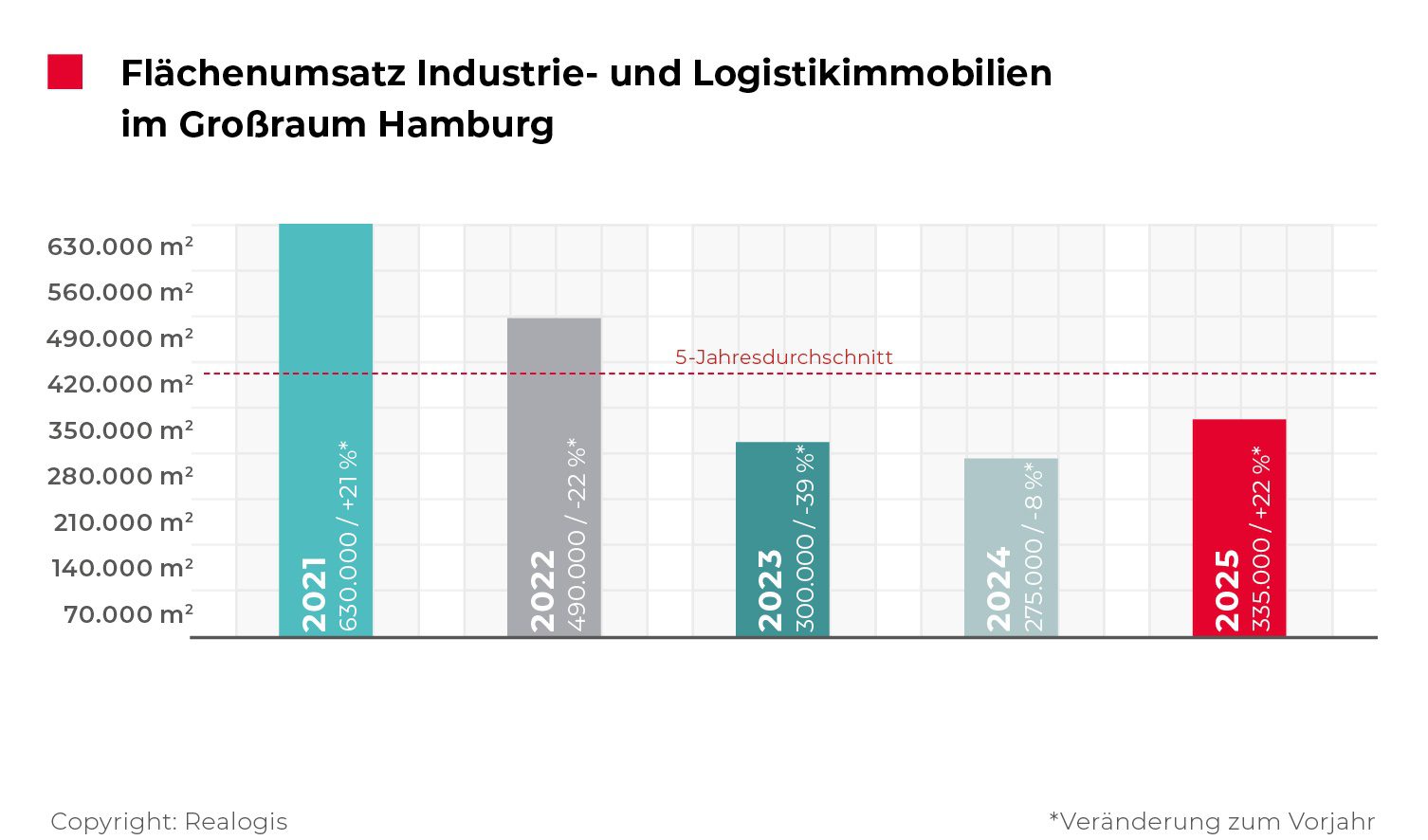

The REALOGIS Group, Germany’s leading consulting firm for industrial and logistics properties as well as commercial properties, recorded take-up of 335,000 m² in the owner-occupier and rental market for logistics and industrial real estate space in Hamburg for the full year 2025. This exceeded the previous year’s result of 275,000 m² by 22%. However, the 5-year average of 406,000 m² was missed by 17%.

The five deals with the highest turnover were accounted for by Körber Technologies (34,300 m²), Mickeleit (20,000 m²), Scan Global Logistics Group (19,600 m²), Garpa Garten & Park Einrichtungen GmbH (19,350 m²) and Heinrich Dehn (15,300 m²). Together, they accounted for 32% of total take-up.

Stefan Imken, Managing Director of REALOGIS Immobilien Hamburg GmbH, puts it in perspective: “The increase in take-up is primarily a sign of an incipient stabilisation, even if the level of previous peak years has not yet been reached. Against this backdrop, we expect a gradual continuation of the market recovery in 2026, supported by continued solid to increased demand from logistics and industry as well as an overall stable rental trend.”

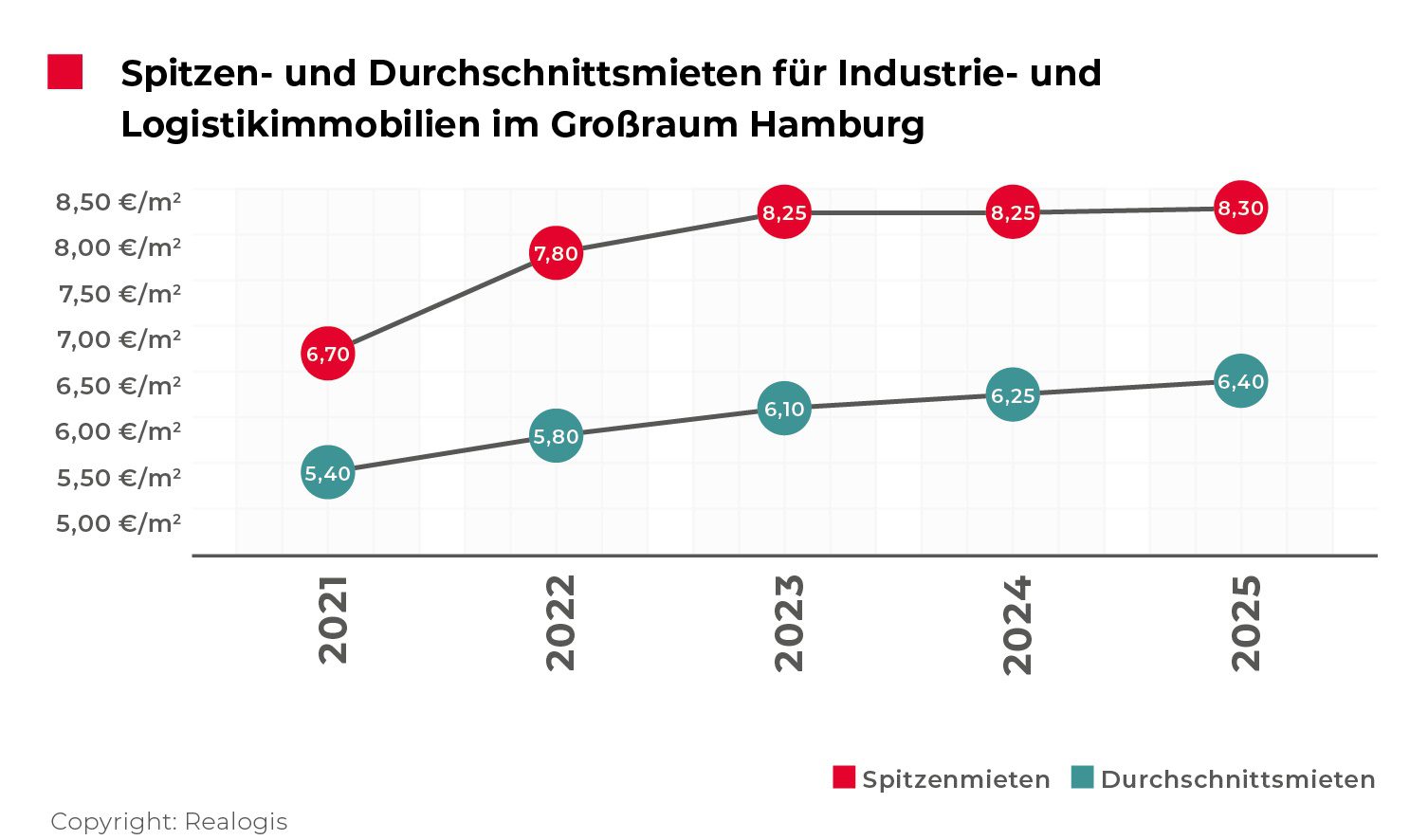

Rents: Prime rent at €8.30/m², average rent at €6.40/m²

The prime rent in 2025 ranged at €8.30/m². Compared to the previous year (€8.25/m²), this represented an increase of 0.6% or 5 ct/m². In the course of the year, the prime rent had reached €8.40/m² at the end of June, falling by 10 ct/m² in the 2nd half of the year.

The average rent at the end of the year was €6.40/m² (2024: €6.25/m²). At the end of June 2025, it was €6.50/m², which is 10 ct/m² more.

Land types: existing areas dominated; New construction mainly on brownfields

Market activity in 2025 was largely concentrated on existing properties. A total of 224,300 m² was let here, which corresponds to a share of take-up of 67% (2024: 230,000 m² / 84%). The leases concluded by Mickeleit and Heinrich Dehn played an important role in this and were responsible for 16% of the take-up of existing space.

A total of 110,700 m² or 33% of new buildings were let in the Hamburg market. Significant were the deals in newly constructed buildings on former brownfields; They accounted for 109,200 m² or 32.6% of total market take-up. Körber Technologies, Scan Global Logistics Group and Garpa Garten & Park Einrichtungen GmbH accounted for 67% of brownfield sales. New buildings on greenfield sites, on the other hand, reached only 1,500 m² (0.4%); in the previous year it had been 45,000 m² (16%).

Market structure: Leases in the majority, big box spaces at the top

In 2025, the market was again predominantly determined by leases. Tenants took up 274,700 m² and thus accounted for 82% of market activity (2024: 240,000 m² / 87%). Owner-occupiers accounted for 60,300 m² or 18% (2024: 35,000 m² / 13%).

In terms of building types, big-box space accounted for the largest share of take-up: 175,000 m² or 52%. Areas that could not be assigned to big boxes or business parks accounted for 81,900 m² or 25%, while business parks accounted for 78,100 m² or 23%.

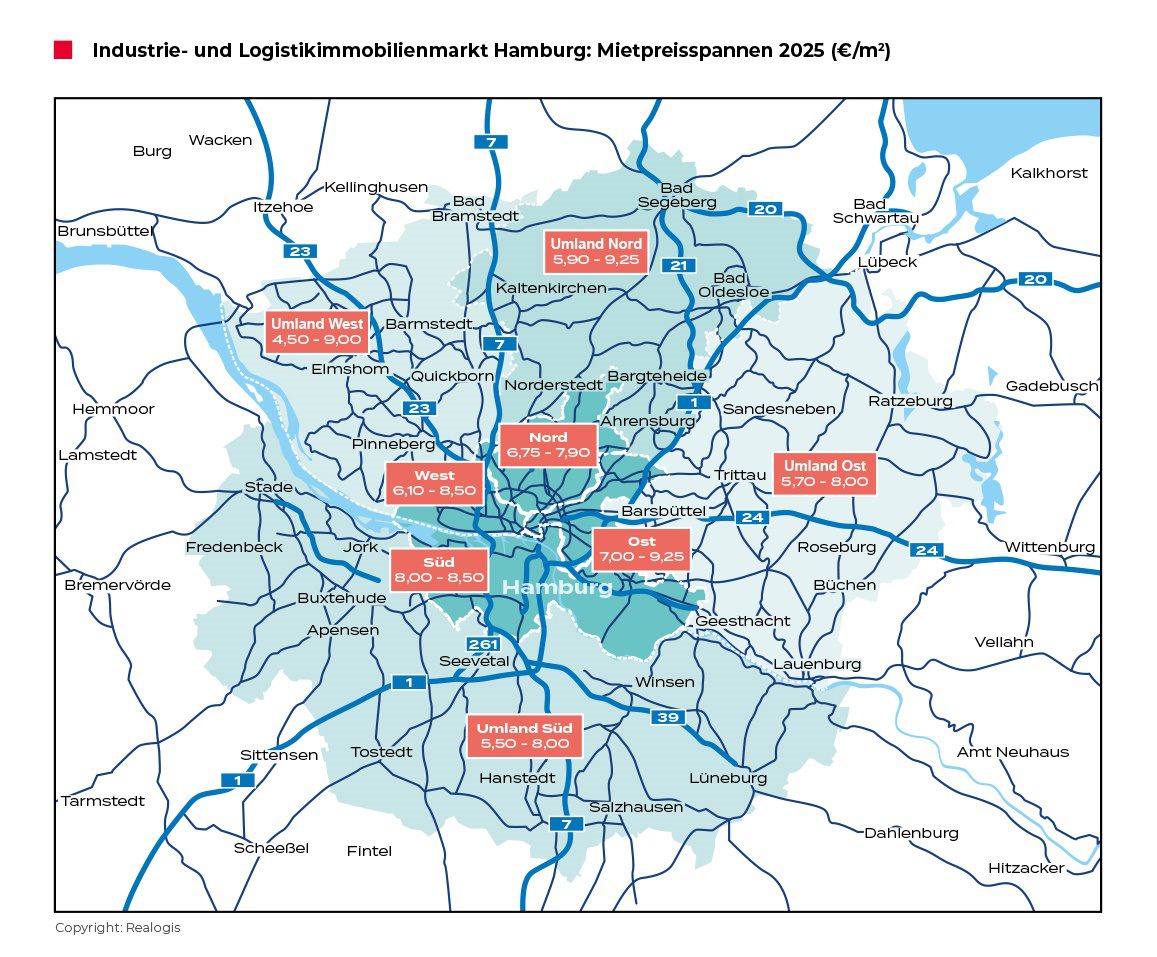

Regions: The south takes the lead, the eastern submarket just behind

The most sought-after region in 2025 was the south of Hamburg (urban area and surrounding area south) with 141,400 m² or 42% market share (2024: 22,000 m² / 8%). With growth of 119,400 m² or 543%, the south, which was still in last place last year, achieved the most significant growth of all regions. The major deals by Mickeleit, Scan Global Logistics Group and Garpa Garten & Park Einrichtungen GmbH totalling 58,950 m² made a significant contribution to the recovery after the slump in 2024.

The east accounted for 131,900 m² or 39% (2024: 115,000 m² / 42%). In the west, take-up of 35,800 m² or 11% was registered, which corresponded to the largest decline among the individual regions of the Hanseatic city (2024: 92,500 m² / 34%). Only the north of Hamburg was behind with 25,900 m² or 8% share of take-up (2024: 45,500 m² / 16%).

Industries: Logistics/freight forwarding clearly in the lead, retail had reached 44,700 m²

Logistics/freight forwarding accounted for 209,900 m², accounting for 63% of take-up (2024: 129,000 m² / 47%). Industry/production reached 52,000 m² and thus a share of 16% (2024: 35,000 m² / 13%). Retail recorded 44,700 m², which corresponded to 13% (2024: 96,000 m² / 35%). Within retail, 22,800 m² (51%) was accounted for by e-commerce and 21,900 m² (49%) by traditional retail. The “Other” category totalled 28,400 m² or 8% of take-up (2024: 15,000 m² / 5%).

Size classes: Large areas from 10,001 m² as a pacesetter

In 2025, the most popular areas were for space of 10,001 m² or more, accounting for 131,000 m² or 39% (2024: 25,000 m² / 9%). This was followed by deals between 5,001 and 10,000 m² with 84,600 m² and 25% (2024: 55,000 m² / 20%). The segment of 1,000 to 3,000 m² accounted for 53,100 m² or 16% (2024: 66,000 m² / 24%), closely followed by the segment between 3,001 and 5,000 m² with 49,000 m² or 15% (2024: 53,000 m² / 19%). Very small areas of less than 1,000 m² accounted for 17,300 m² or 5% (2024: 76,000 m² / 28%).

Key figures at a glance

* Take-up: 335,000 m²

* Prime rent: €8.30/m² (2024: €8.25/m²)

* Average rent: €6.40/m² (2024: €6.25/m²)

* Existing space: 224,300 m² | New building on a greenfield site: 1,500 m² | New building on brownfield: 109,200 m²

* Tenants: 274,700 m² (82%) | Owner-occupiers: 60,300 m² (18 %)