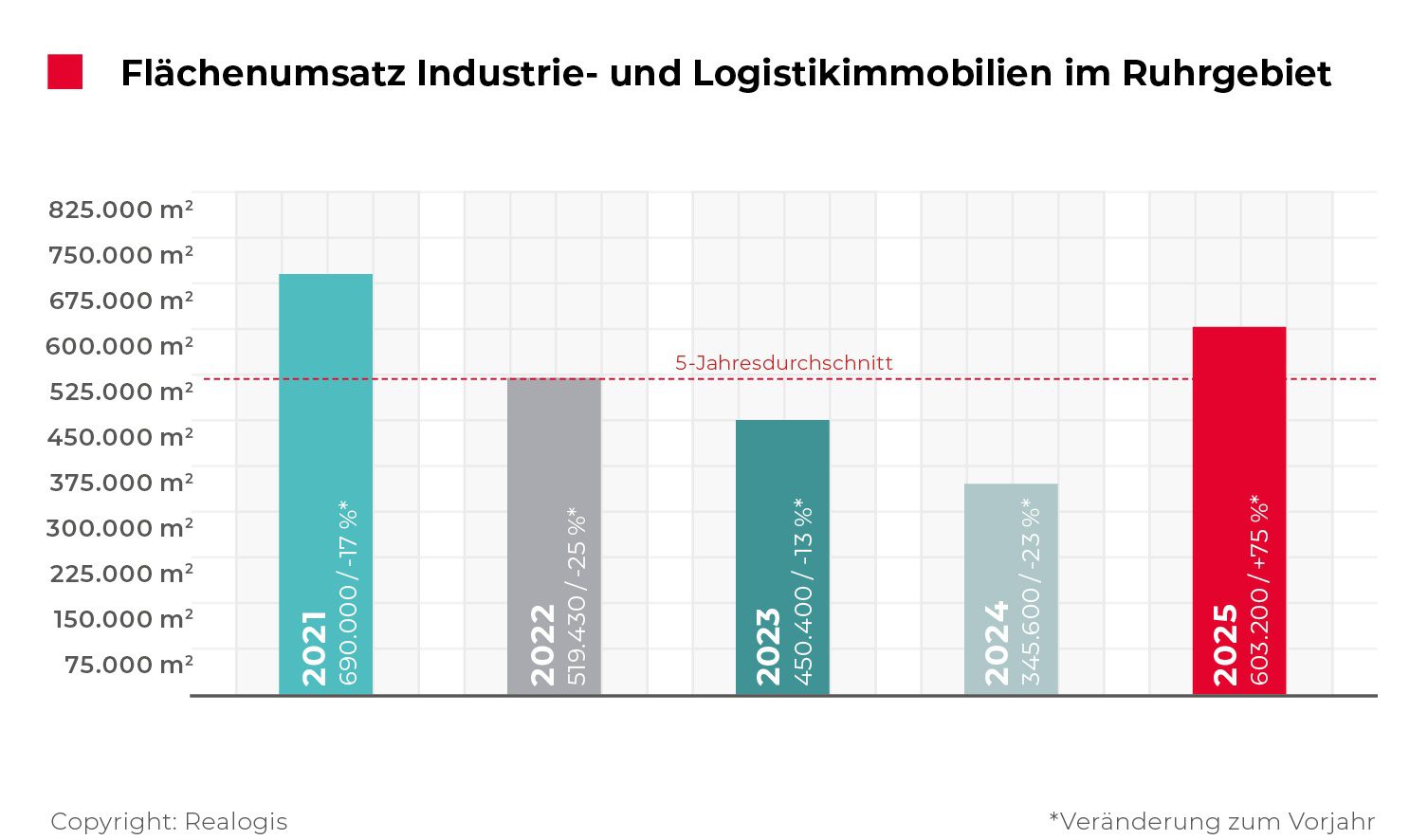

- Take-up increased by 75% to 603,200 m²

- Rent level stable

- Existing space remained the supporting pillar with 305,500 m²

- Big box spaces dominated market activity

- Companies from the logistics/freight forwarding sector are the strongest buyers

The REALOGIS Group, Germany’s leading consulting firm for industrial and logistics real estate as well as commercial properties, registered take-up of 603,200 m² in the industrial and logistics real estate market in the Ruhr region in the 2025 financial year.

This was the first time in five years that take-up rose again and was again above the 600,000 m² mark, which was last the case in 2021. Compared to the previous year, there was an increase of 257,600 m² or 75% (2024: 345,600 m²). The 5-year average of 521,726 m² was exceeded by 16%.

The five largest revenue generators accounted for 248,000 m² or 41% of total take-up. The largest lettings were accounted for by Amazon (86,000 m²), FIEGE (55,000 m²), Blitz Distribution (37,000 m²), Winnet (36,000 m²) and JD Logistics (34,000 m²).

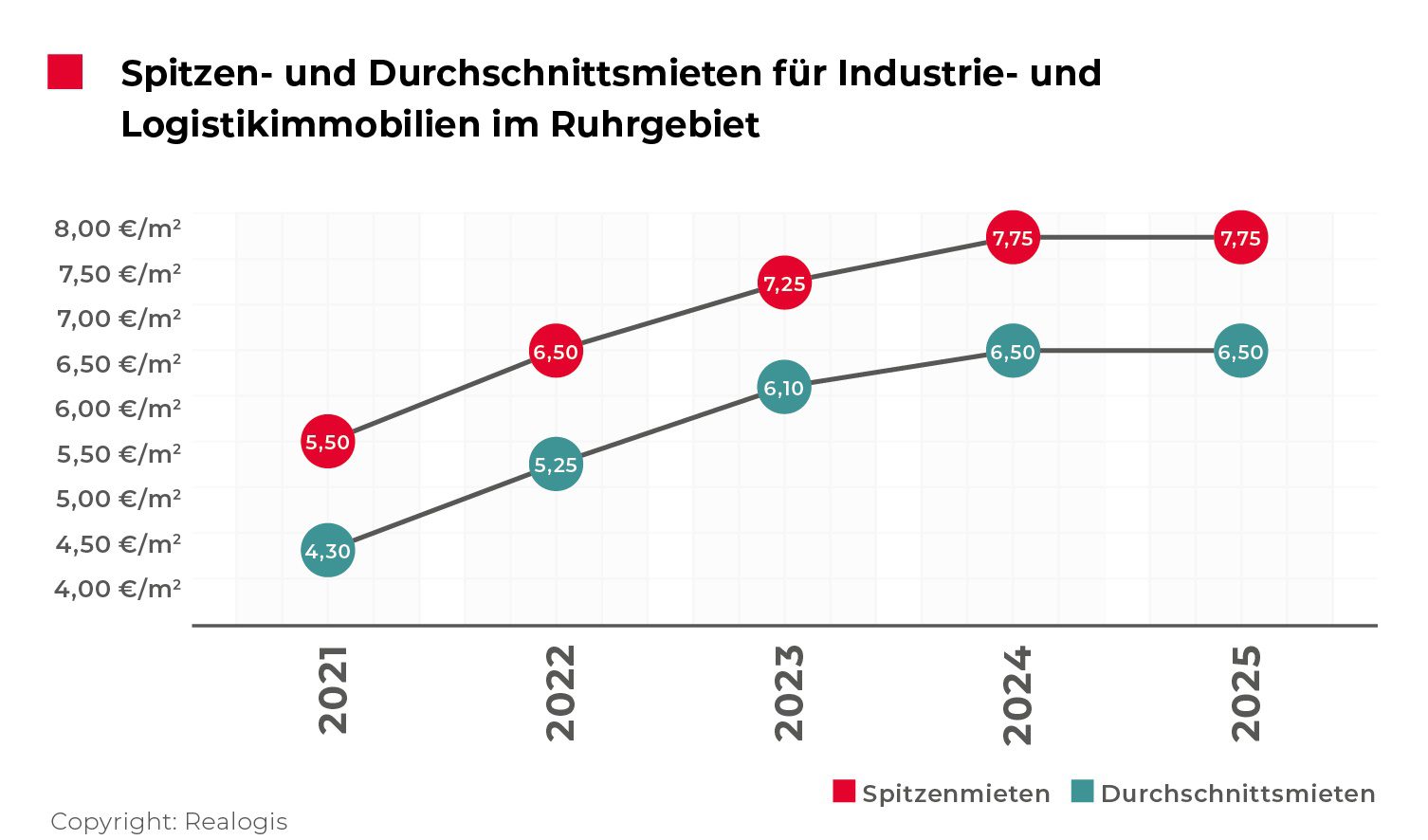

Rents: No changes in prime and average rents

Both the prime rent of €7.75/m² and the average rent of €6.50/m² were at the level of 2024 at the end of 2025. Both values had also been registered for the 1st half of 2025.

Take-up: portfolio in the lead, brownfields with strong growth

Existing areas will remain the most important pillar in the Ruhr region in 2025. It accounted for 305,500 m², or 51% of take-up (2024: 256,200 m² / 74%). Compared to the previous year, this corresponds to an increase of 49,300 m² or 19%.

New construction sites on former brownfields will noticeably gain in importance again in 2025. Here, 189,100 m² was let, which corresponded to a share of 31% of take-up (2024: 89,400 m² / 26%). Amazon and Winnet together accounted for 65% of brownfield operations, with Amazon alone accounting for 45%.

New greenfield buildings accounted for 108,600 m² in 2025, an 18% market share. In the previous year, no deals were registered in this segment.

The Ruhr area market area will remain a pure rental market in 2025. Rentals by owners were not recorded.

Building types: Big box spaces remained dominant

In terms of building type, big-box space maintained its top position with 506,800 m² or 84% market share (2024: 237,800 m² / 69%). The result corresponds to a significant increase of 269,000 m² or 113% compared to the previous year.

Other properties that cannot be assigned to either the category of big-box properties or business parks followed with 94,000 m² and a share of 16% (2024: 79,700 m² / 23%). With 2,400 m² or 0.4% market share, business parks played only a subordinate role (2024: 28,100 m² / 8%).

User groups: Logistics/freight forwarding clearly ahead, trade in second place

The highest activity in 2025 was recorded by companies in the logistics/freight forwarding sector. The industry accounted for 413,700 m² or 69% market share (2024: 168,600 m² / 49%). In a year-on-year comparison, this corresponds to growth of 245,100 m² or 145%. The 5-year average of 264,845 m² was thus exceeded by 56%. The most significant deals in this user group included the leases by FIEGE (55,000 m²), Blitz Distribution (37,000 m²), Winnet (36,000 m²) and JD Logistics (34,000 m²). Together, these four lettings accounted for 162,000 m² or 39% of the industry’s turnover.

Deals by retail companies followed in second place with 133,600 m² or 22% market share (2024: 126,800 m² / 37%). Within retail, e-commerce dominated with 113,900 m² and 85% of retail space take-up (2024: 109,900 m² / 87%). With 86,000 m², Amazon accounted for 76% of e-commerce sales. Traditional retail reached 19,700 m² or 15% (2024: 16,900 m² / 13%).

Industry/production accounted for 49,500 m² and 8% market share in 2025 (2024: 26,300 m² / 7%). Other sectors were responsible for take-up of 6,400 m² or 1% market share (2024: 23,900 m² / 7%).

Size classes: Large areas from 10,001 m² characterise the market

Large spaces of 10,001 m² or more continued to dominate in 2025. It accounted for 506,800 m² and thus 84% market share (2024: 237,800 m² / 69%). In absolute and percentage terms, take-up increased by 269,000 m² or 113% compared to the previous year, which was accompanied by an increase in importance of 15 percentage points. All five of the largest deals, each comprising at least 30,000 m², were registered in this size class. Units between 5,001 m² and 10,000 m² contributed 49,500 m² or 8% (2024: 40,200 m² / 12%). The two largest space categories of 5,001 m² or more accounted for a total of 92% of market activity in 2025 (2024: 80%).

The segment between 3,001 m² and 5,000 m² accounted for 34,600 m² or 6% (2024: 41,500 m² / 12%). Areas between 1,000 m² and 3,000 m² reached 12,300 m² and a share of 2% (2024: 25,000 m² / 7%). Small areas of less than 1,000 m² will not play a role in 2025.

Key figures at a glance

- Take-up: 603,200 m²

- Prime rent: 7.75 €/m²

- Average rent: €6.50/m²

- Existing areas: 305,500 m² | New building on brownfields: 189,100 m² |

New building on a greenfield site: 108,600 m² - Tenants: 603,200 m² | Owner-occupier: 0 m²