This article is translated automatically.

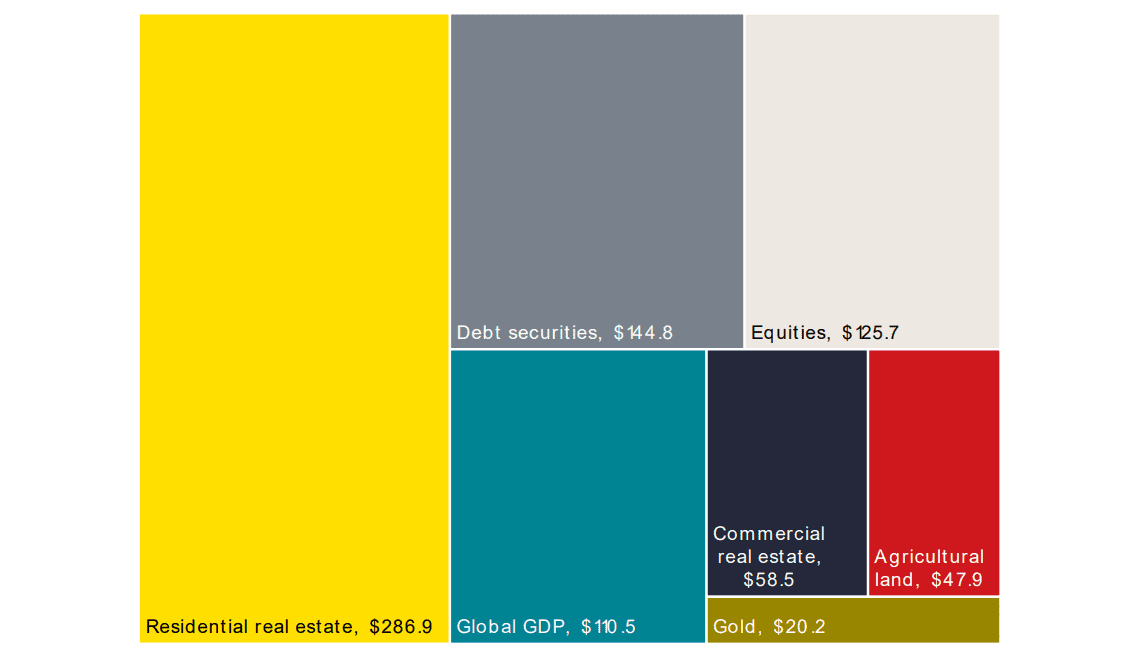

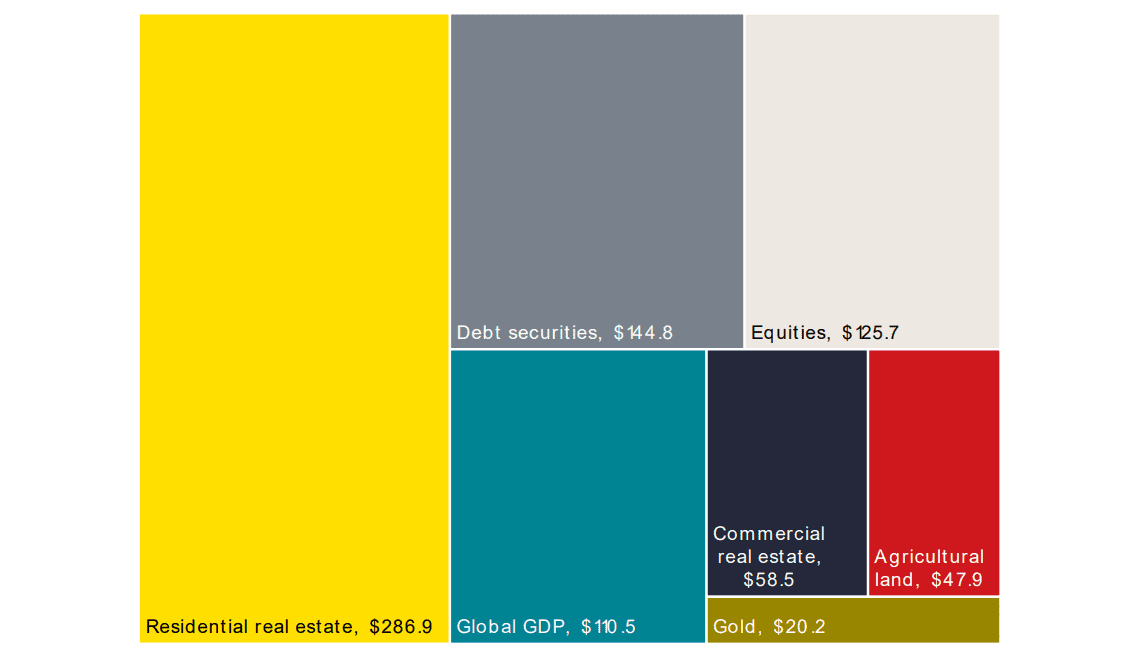

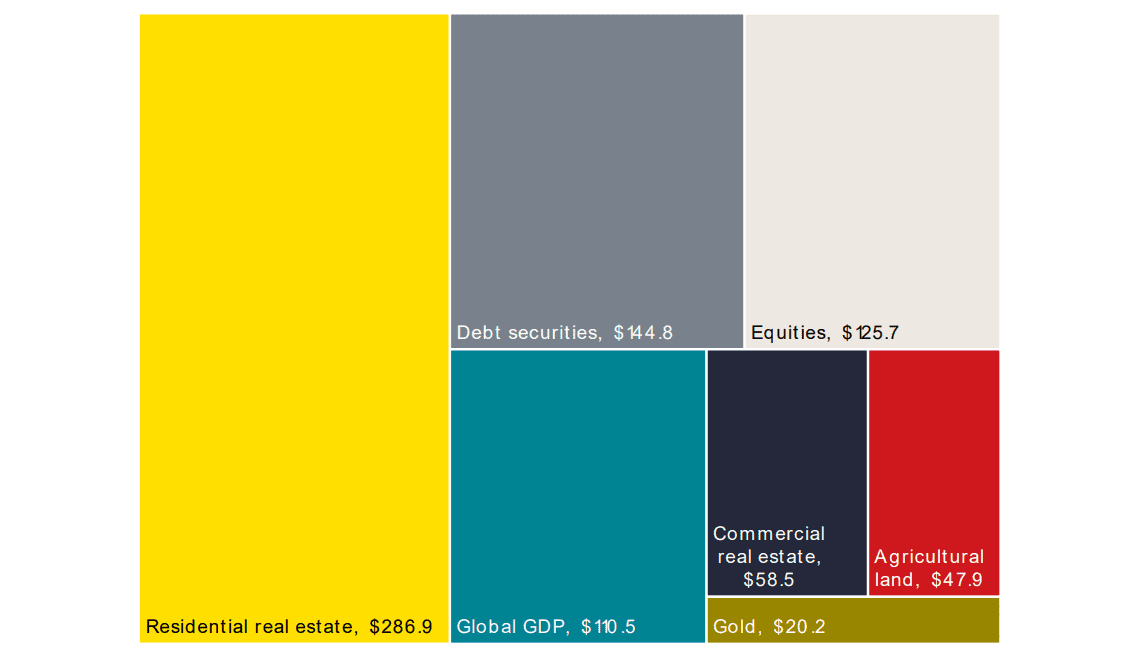

Savills: Global real estate assets worth nearly $393.3 trillion – around four times global GDP – remains the world’s largest store of wealth

Quelle: Savills Research unter Verwendung von Daten des IWF, der Bank für Internationalen Zahlungsausgleich, der World Federation of Exchanges und des World Gold Council. Hinweis: Die von Savills angegebenen Gewerbeimmobilien umfassen das gesamte Spektrum, einschließlich weniger liquider Vermögenswerte wie Schulen, öffentliche Gebäude und Krankenhäuser, nicht nur von institutionellen Investoren gehaltene Objekte.

According to Savills, the value of all global real estate (residential, commercial and agricultural land) amounted to 393.3 trillion US dollars at the beginning of 2025, maintaining its position as the world’s most important wealth store.

The international real estate services provider explains that real estate continues to represent the world’s largest asset class, surpassing the combined value of global stocks, bonds and gold. In fact, the value of all gold ever mined ($20.2 trillion) is just over 5% of total real estate assets. Since 2019, the total value of global real estate has increased by 21.3%, broadly in line with global GDP growth over the same period (25.6%).

Source: Savills Research, using data from the IMF, the Bank for International Settlements, the World Federation of Exchanges and the World Gold Council. Note: The commercial properties reported by Savills cover the full spectrum, including less liquid assets such as schools, public buildings and hospitals, not just properties held by institutional investors.

Savills reports that the total value of global real estate fell slightly by 0.5% year-on-year, driven by a 2.7% decline in the global residential real estate stock to $286.9 trillion . While most countries saw growth in the value of their homes thanks to rising house prices and new construction, falling property values in China – which accounts for a quarter of the world’s residential property value – pushed down the global average.

The value of commercial real estate was $58.5 trillion, up 4.1% on an annualized basis. Growth was supported by the development of new inventories and stabilizing values in some markets, particularly in the U.S., where increased investment in domestic manufacturing as part of the relocation of production provided an additional boost. Agricultural land reached a total value of USD 47.9 trillion, an increase of 7.9% in 2024 . This growth was driven by limited supply and increasing demand due to population growth and higher per capita food consumption.

Paul Tostevin, Head of Savills World Research, comments:

“While the pace of growth may vary by sector and region, the long-term fundamentals of the real estate sector remain strong: real estate is a store of value, an engine of economic growth and development, and its ability to reflect global economic changes ensures its continued relevance in a changing investment landscape. While short-term factors such as elevated interest rates and market cycles can affect the values of certain property types, real estate’s position as the world’s most valuable asset class is likely to remain in the long term.”

According to Savills, China remains the highest real estate market with a share of 23.5% of the global value, followed by the United States with 20.7%. Together with eight other countries – Japan, Germany, the UK, France, Canada, Australia, South Korea and Italy – the ten largest markets account for 71% of the total global property value.