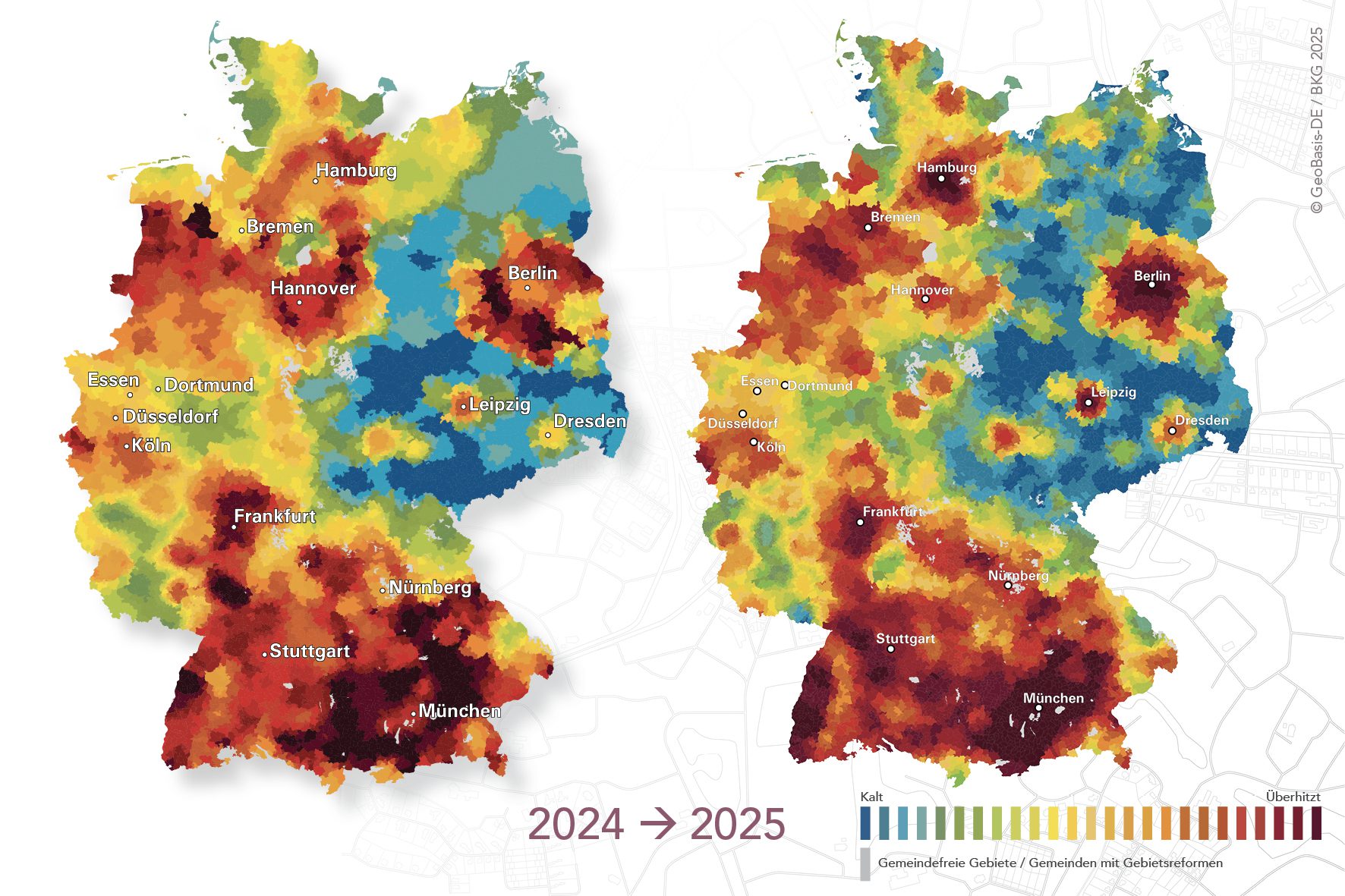

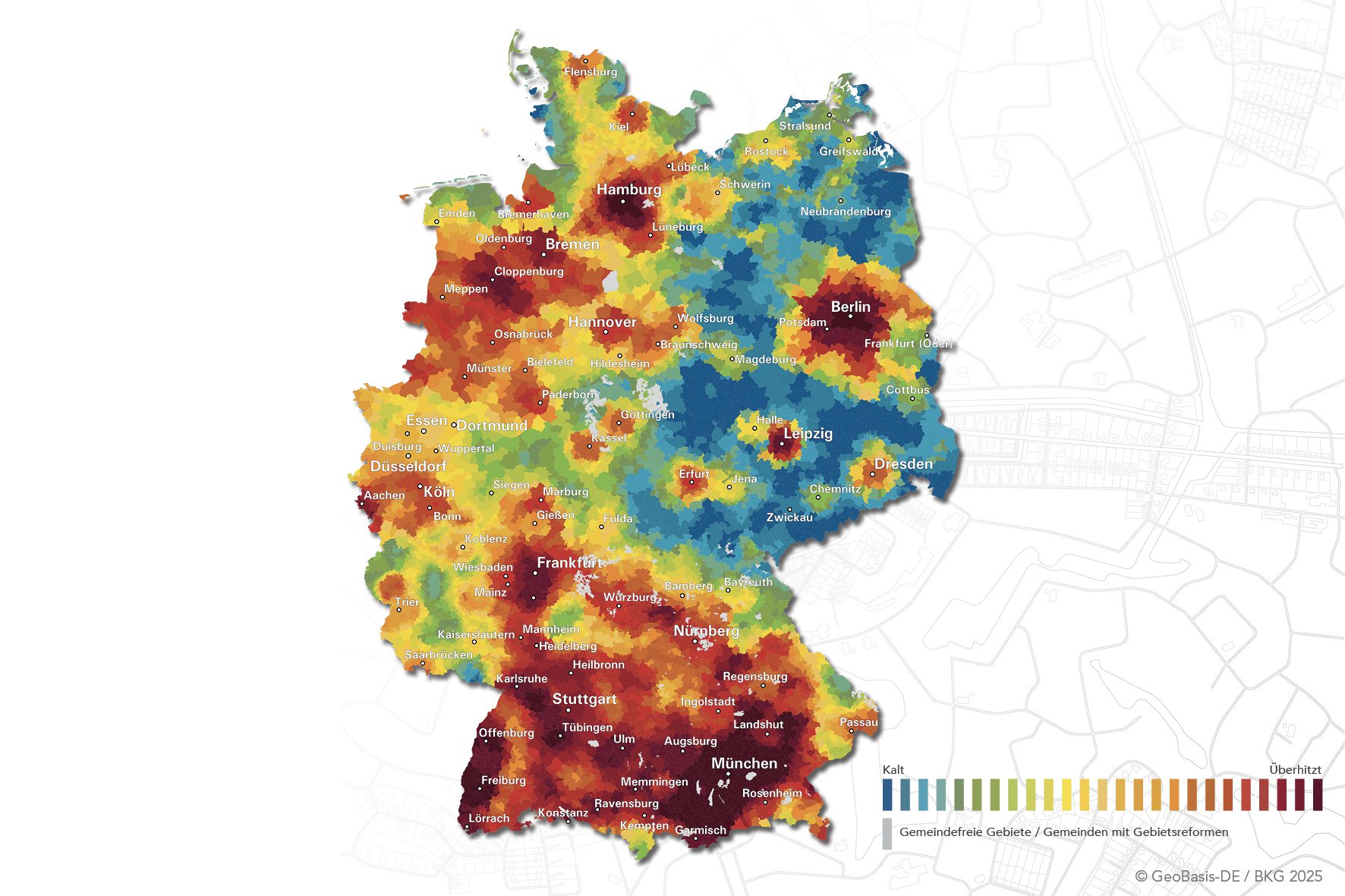

For the seventh time in a row, the project and area developer BPD (Bouwfonds Immobilienentwicklung) and the analysis company bulwiengesa present their joint study on the situation of the housing market in Germany. With the so-called living weather map, living trends and their changes are represented using a colour scale similar to a weather map. Where a high actual demand for housing and a low supply meet, it gets very hot, according to the housing weather map. By the way, the hottest municipality this year is in Bichl in the district of Bad Tölz.

Tension in the housing market remains challenging – trend reversal in the centres

The new residential weather map for 2025 documents a clear shift in demand back to the metropolises. After a phase in which rural areas and surrounding communities heated up sharply, the centres such as those in Munich, Berlin and Hamburg, where the housing market is most tense, are now heating up again. At the same time, the temperature in many surrounding locations is dropping slightly, which makes the map clearly visible in its current edition.

In urban areas, several effects will accumulate in 2025: declining completions will have a particular impact on the city centres, – as a result of the 2022 interest rate shock, residential construction projects that have been started have been completed, but significantly fewer new housing construction requirements have been started. Created in previous years regularly around the

300,000 residential units, so the number of completions fell to 252,000 units in 2024. At the same time, the lack of new ownership formation over the past two to three years has narrowed the rental market, with households staying longer in rented apartments and thus more often in urban areas. In addition, there are higher wage agreements, which have increased the sustainability of rising rents in sub-markets, as well as increasing budget reductions and a high proportion of immigration in the relocation process. This explains the finding of sometimes significantly falling temperatures in many surrounding communities.

Housing demand back to annual level of 2022

The methodology of the residential weather map results in an annual housing requirement of around 440,000 units – and is thus at the level of the 2022 residential weather map edition. The higher prior-year figures are attributable to statistical one-off effects due to the war in Ukraine. The difference to other demand forecasts can be explained by the methodology: In addition to replacement and additional demand, the residential weather map also takes pent-up demand into account – but with reduced weight by building it up gradually (methodically spread over several years). The spatial statement remains decisive: in 2025, the tension will shift more strongly to the large metropolises again. However, the trend of a further warmer living climate in the smaller cities will continue unabated in 2025.

For the first time, opposing developments in rural areas between East and West

While large cities in eastern Germany – such as Leipzig, Dresden or Erfurt – continue to record strong demand and a warm living climate, the picture is different in rural areas. What is new is a countervailing trend in the rural regions between East and West Germany, which can be observed for the first time! While in recent years there has been an overall cooler living climate in rural areas throughout Germany, with the differences between west and east being fluid, there is now a warmer living climate in rural regions in the west, with a few exceptions. On the current residential weather map, this is characterized by the fact that the coldest shade of the scale no longer appears in the western regions. In rural areas in eastern Germany, on the other hand, demand remains low, so the living climate remains cold. This is where the demographic development is particularly noticeable.

Consequences for practice and politics

The diagnosis of a return of the big cities does not mean the end of the relevance of the surrounding areas. Suburban locations remain important alternative spaces, especially for tenant households, and can also provide impetus for the formation of property ownership again if financing conditions improve. It is crucial to take a differentiated view along local demand profiles and financial viability.

For municipalities and project developers, the task is to tailor product concepts even more precisely to local demand profiles, to accelerate planning and approval procedures and to make targeted use of serial or semi-serial construction, densification and conversion in order to expand supply and price points in the tense sub-markets.

“The new residential weather map shows the comeback of the big cities. Demand is once again concentrated more in the centres – and it is precisely there that there is the greatest shortage of apartments. We need speed in planning and construction as well as offers that broad income groups can afford. This is the only way to noticeably relieve the pressure on the market,” says Alexander Heinzmann, CEO of BPD in Germany.

“The data shows how the declines in completions are having an impact in the metropolises, while a narrowed rental market is prolonging the stay in the city. Higher wage agreements, smaller households and immigration are also supporting urban choice of place to live – this explains the new heat in the centres,” says Felix Embacher, Business Owner RIWIS at bulwiengesa.

Learn more