Example heading

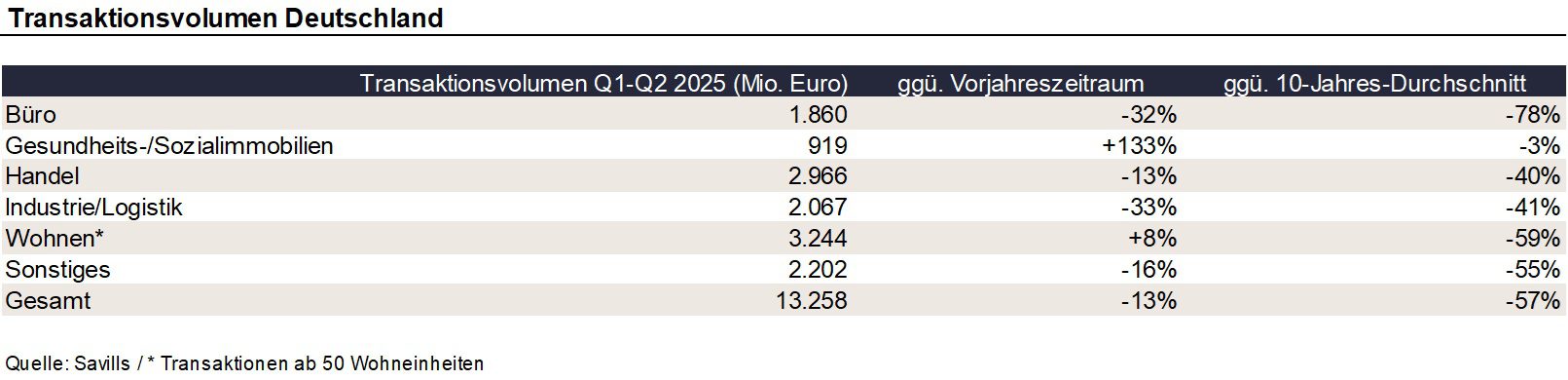

In the 1st half of 2025, commercial and residential real estate* changed hands on the German real estate investment market for around EUR 13.3 billion. Compared to the same period last year, this represents a decrease of 13%. The number of completed transactions in the first six months of the current year was also 12% below the previous year’s figure. Compared to the 10-year average, the transaction volume was 57% lower and the number of transactions was 55% lower. Karsten Nemecek, Deputy CEO Germany and responsible for Capital Markets, comments on the current market environment as follows: “Measured in terms of revenue and the number of completed transactions, the second quarter in particular was very weak. However, this is offset by a significant increase in the number of ongoing and imminent transaction processes. Against this background, it can be assumed that we will see more transactions again in the second half of the year. The only thing that remains to be seen is how strong the increase will be, as numerous processes continue to be cancelled or come to a standstill. Nevertheless, the conditions for successful deals have recently improved: many sellers now estimate the achievable prices more realistically, and the number of active buyers has increased noticeably. Since the formation of the new federal government and the investment packages it has adopted, the group of international investors in particular has been much more optimistic about the German market.”

Revenue decline in all segments except healthcare/social real estate and residential

Residential real estate is one of the few segments that bucked the general trend to see growth in transaction volume. Sales of EUR 3.2 billion in the first half of the year represent an increase of 8% compared to the same period last year and at the same time the highest turnover of all types of use. This is followed by retail real estate (EUR 3.0 billion / – 13%), industrial/logistics real estate (EUR 2.1 billion / – 33%) and offices (EUR 1.9 billion / – 32%). Healthcare and social real estate accounted for a volume of EUR 0.9 billion, which is more than double the previous year. This jump in sales is likely to be put into perspective in the further course of the year, as a large part of this year’s volume was attributable to the sale of a nursing home portfolio from Deutsche Wohnen AG. In other segments, too, some exceptional transactions made a significant contribution to the transaction volume. In total, the ten largest transactions of the 1st half of the year add up to a volume of approx. EUR 3.7 billion, i.e. more than a quarter of the total volume.

Exit overhang across all types of use, especially for offices

For all uses, the number of properties traded has been below the level reached at the end of the last cycle for three years now, in some cases well below the level achieved. Savills therefore assumes that there is a latent supply surplus across all segments, which is becoming increasingly larger. This overhang is likely to be greatest for office properties, explains Matthias Pink, Head of Research Germany at Savills: “In the years 2015 to 2021, an average of almost 700 office properties changed hands per year nationwide. Since 2023, there have been fewer than 200 properties per year. In view of a typical holding period of three to ten years, a four-digit number of offices are now likely to be owned by owners who would have already sold if there had been sufficient market liquidity. This exit overhang will initially continue to grow. However, since only a few investors can delay their exit for an indefinite period of time, the selling pressure is likely to increase, at least for some of the owners.”

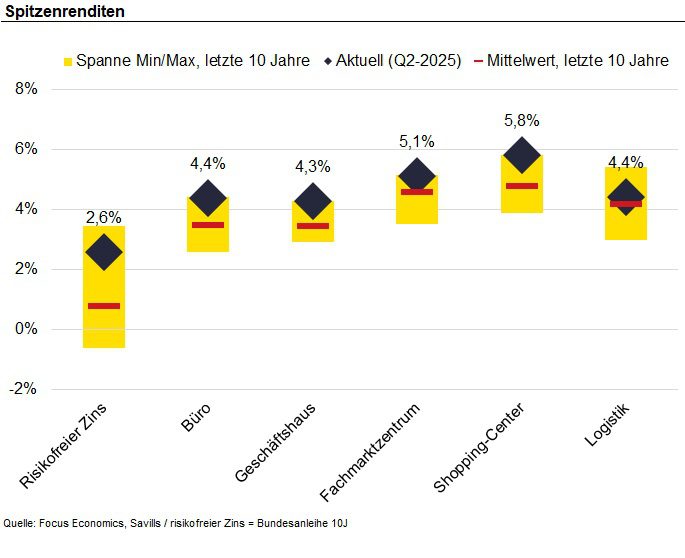

Prime yields stable, family offices on the verge of a new record year

In the few core transactions observed by Savills in the last quarter, the prime yields of the previous quarter were confirmed. These therefore remain unchanged between 3.6% for multi-family buildings and 5.8% for shopping centres. “For top products, we are seeing more bidders in the processes again, at least with volumes in the double-digit million euro range. At the same time, the number of potential investors remains limited in most segments. It is still mainly private sources of capital that are taking advantage of the reluctance of many institutional investors for countercyclical purchases,” explains Nemecek. So far this year, private investors and family offices have already invested almost 2.4 billion directly, almost as much as in the entire previous year. This group accounts for just under a fifth of the purchase volume. If a similarly high volume were to be added in the second half of the year, it would be a new record. Overall, Savills expects a transaction volume of between EUR 35 billion and EUR 40 billion for the current year, which would be roughly equivalent to the previous year’s figure (EUR 36.7 billion).

* only transactions from 50 residential units