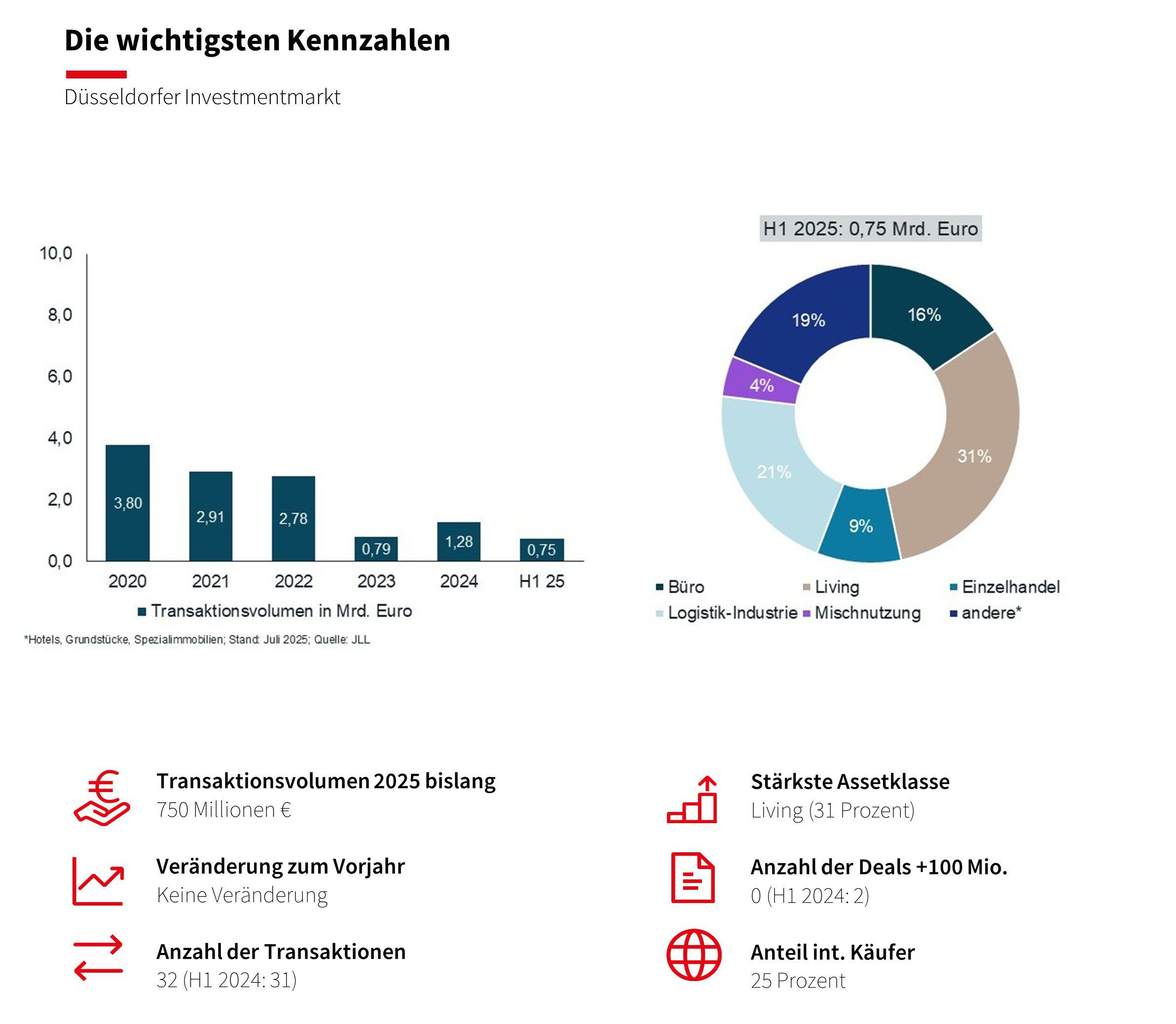

Market will reach exactly the same level as the previous year by the first half of 2025

With 19 transactions, the trend on the Düsseldorf real estate investment market is again pointing more clearly upwards. So many sales have not been registered in the NRW state capital since Q1 2022. For the first half of the year, the market has 32 transactions. But with an average volume of 23 million euros, it can only make limited leaps, especially since major deals with more than 100 million euros continue to fail to materialize. For example, 750 million euros were recorded at the end of the first half of the year – the same amount as at the same time last year. But it is still a long way from the average of the past five years of 1.23 billion euros.

Marcel Abel, Managing Director and Branch Manager of JLL Düsseldorf: “After the setbacks of recent years and the current political, economic and geopolitical challenges, it is not surprising that investors are only slowly returning to the investment market with small and medium-sized properties. The fact that they are increasingly doing so is a good sign. Higher volumes will then follow over time, as soon as the floor of the Düsseldorf market is tread-proof again.”

Significant deals in the second quarter were the sale of the Carsch House from the Signa insolvency and a plot of land in the Neuss submarket, which 3M sold to the developer Panattoni. The living asset class continues to lead the field with 31 percent, but with the logistics industry (21 percent), real estate (17 percent) and office (16 percent), a balanced field of pursuers follows. Not least due to the real estate transactions, the current core share in Düsseldorf is rather low at 26 percent, while core-plus with 47 percent and value-add with 27 percent have in some cases significantly higher shares of the transaction volume.

Meanwhile, a look at prime yields shows a silver lining: “For the first time since the beginning of the pandemic, prime office yields have fallen again – by five basis points to 4.50 percent. The coming quarters will have to show whether this can already become a trend,” observes Marcel Abel. Commercial buildings on the main shopping streets are unchanged at 3.60 percent, while prime yields for logistics properties have risen slightly by ten basis points to 4.40 percent.