In 2026, the (re)financing gap in the German real estate market will rise to around 8.5 billion euros, according to estimates by PTXRE, the people-tech company in the real estate sector. The conditions for real estate financing thus remain tense. At the same time, other ESG requirements will become relevant at the beginning of the year, in particular those relating to energy standards, reporting obligations and taxonomy compliance. In particular, portfolio holders and investors of non-ESG-compliant properties are coming under pressure to act. Against this backdrop, PTXRE expects a selective market environment with targeted investments in resilient segments such as logistics, hotels and food-anchored retail. A transaction volume of around 40 billion euros is forecast for the investment market. In the office segment, demand in the coming year will be concentrated on core products and properties with more lucrative initial yields and clearly predictable capital expenditures. Particularly in the areas of compact forms of housing, subsidised housing and energy-efficient portfolios, there are entry opportunities for residential investors.

These are the key findings of the PTXRE study “Outlook 2026: Markets under new rules of the game”, which was published today.

Commenting on the study results, Piotr Bienkowski, Managing Director of PTXRE, said: “The ability to correctly assess resilience factors and respond flexibly to a persistently tense financing and tightening regulatory environment will be key to investment success in 2026. 2026 will be a year of capital selection. Those who finance flexibly and focus on resilient market segments can also invest successfully in 2026 and achieve alpha.”

2026 will be the ESG standard year

Three regulatory strands will become binding in 2026:

- The Energy Performance of Buildings Directive (EPBD) increases the pressure to renovate through new efficiency standards for non-residential buildings.

- From January, the Carbon Border Adjustment Mechanism (CBAM) will make CO₂-intensive building material imports such as steel or cement more expensive and have a direct effect on construction and renovation costs.

- In addition, the Corporate Sustainability Reporting Directive (CSRD) already requires the preparatory development of ESG data structures and reporting systems, despite the postponement of the deadline.

Investors and portfolio holders are thus forced to adapt their strategies by driving energy audits, clearly quantifying decarbonization pathways and ESG goals, and aligning cost and supply chains with low-carbon evidence.

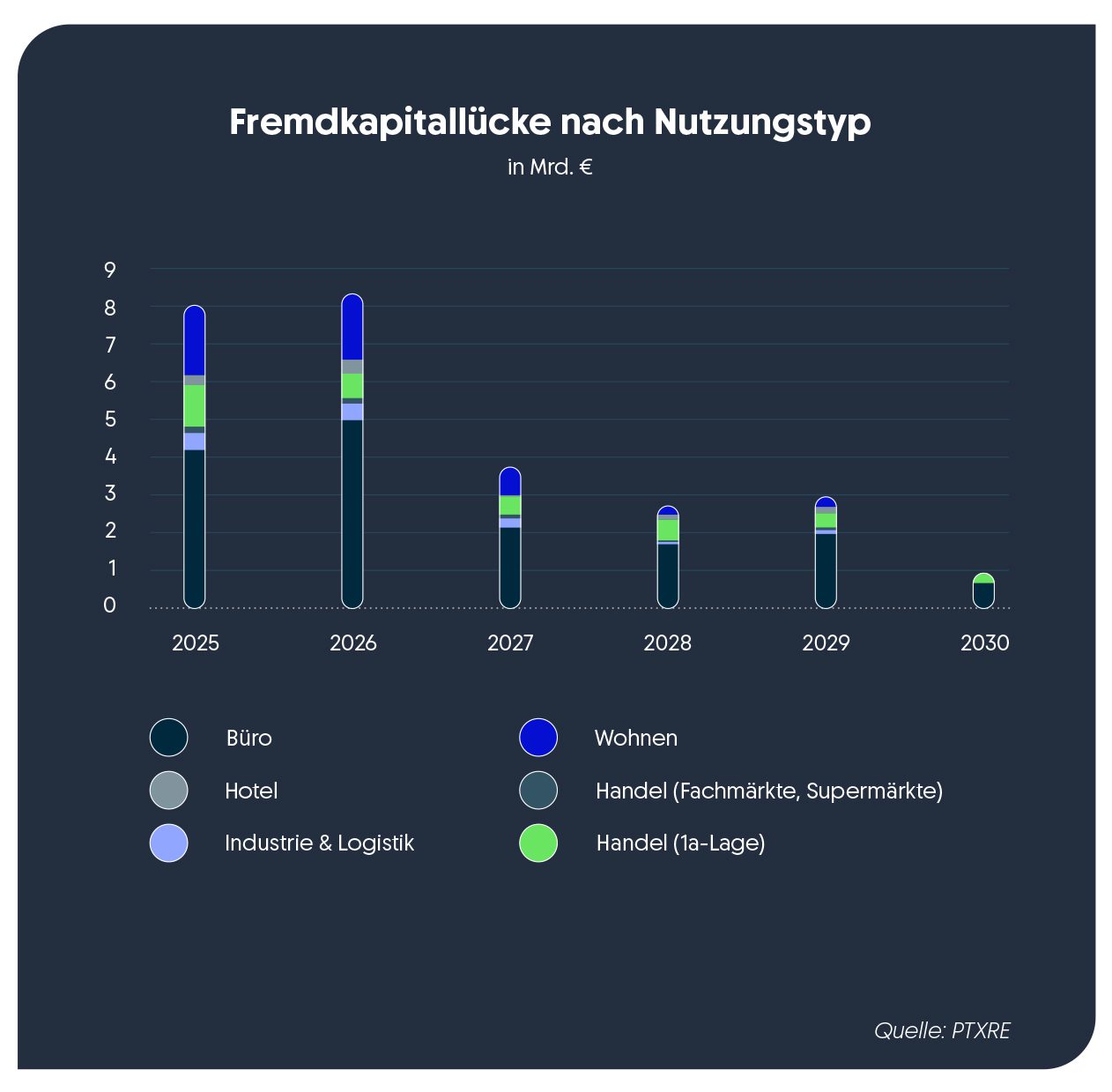

Financing gap: share of office properties dominates at 60 percent

The financing gap will remain a key influencing factor in 2026. Office properties remain particularly affected, accounting for around 5.1 billion euros, or almost 60 percent of the total volume. The implementation of Basel IV and CRR III will further increase the requirements of banks in 2026, which will have a noticeable impact on lending. Higher margins and a declining risk appetite are making financing more expensive, especially in the non-core segment. Falling key interest rates therefore have no effect.

Andreas Trumpp FRICS, Head of Market Intelligence & Foresight at PTXRE, says: “Beyond 2026, the capital gap is likely to remain a market-shaping factor, albeit to a lesser extent, until it reaches pre-interest rate crisis levels in about five to six years, according to our forecast.”

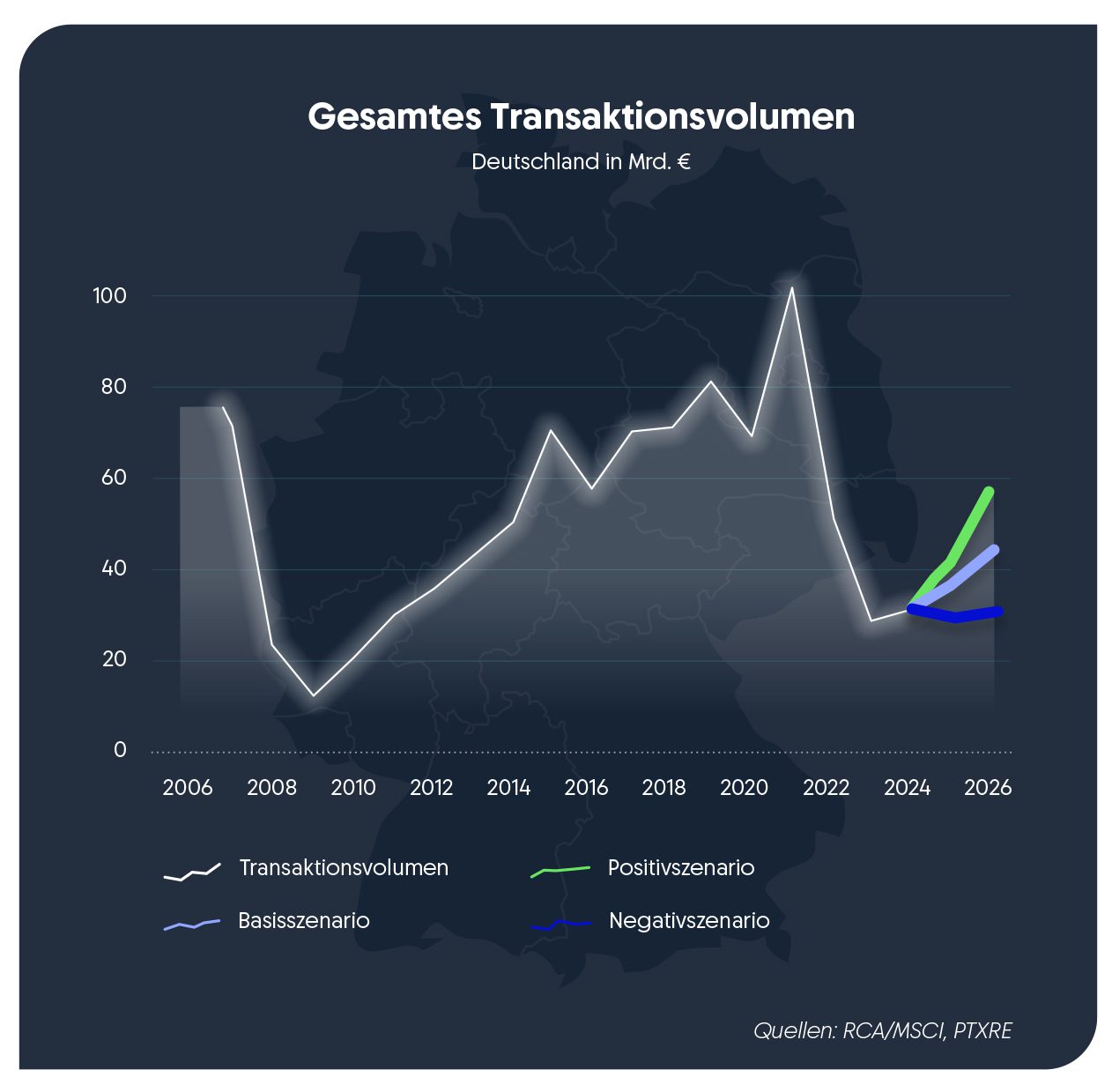

Investment market: Re-allocation instead of upswing

The investment market in 2026 will be driven in particular by re-allocations as part of portfolio optimisations. New allocations remain cautious in view of high real estate ratios among institutional investors and weak capital commitments in the core/core-plus sector. Against this background, PTXRE expects a transaction volume of around EUR 40 billion by the end of 2026 in the baseline scenario for the overall market in Germany.

Resilient asset classes score, selective opportunities in the office market

In the office market, there are entry opportunities for properties in central locations with the potential to increase rents, while demand for rental space remains subdued overall. Prime rents are being driven up further due to low new construction volumes and the location and quality preference of many tenants, while peripheral locations are coming under pressure.

PTXRE expects the number of completions to fall to 175,000 apartments – with a demand of over 300,000 residential units. Especially in the top 7 cities, the supply remains tense. It can be assumed that government interventions such as the “construction turbo” will only have an effect in the medium term.

In the industrial and logistics real estate sector, structural drivers such as defence, data use and network security are ensuring continued high demand and further rental growth, especially in hotspots with limited space supply. Retail properties benefit from stable demand in the local supply sector, while mixed-use and adapted concepts create new opportunities in inner-city locations and secondary locations. The hotel market is experiencing a noticeable upturn, driven by rising overnight stays and expansion plans by international operators – the focus is on urban locations and the 3- to 4-star segment.

The study can be downloaded here