Take-up remains constant at 4.35 million m² after three quarters

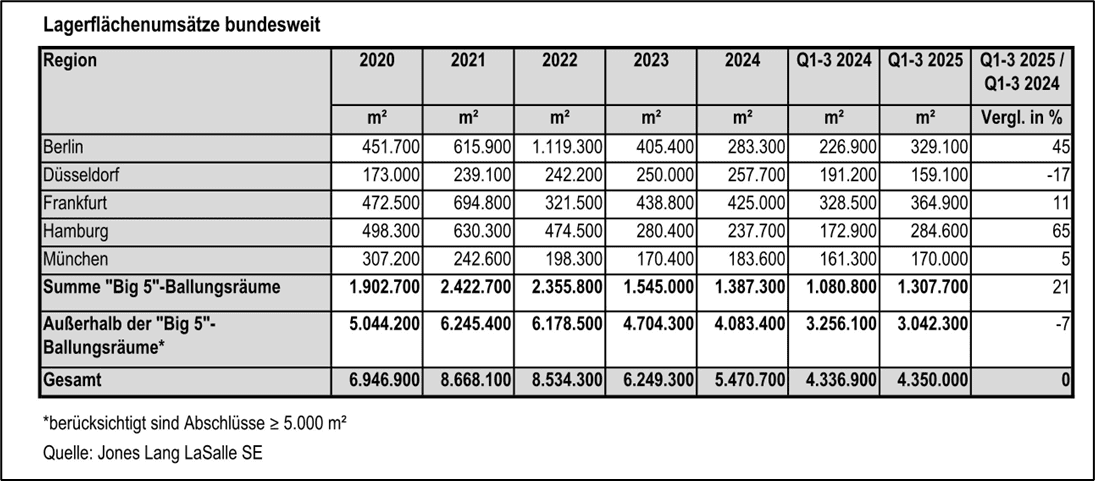

The German market for warehouse and logistics space is extremely stable after three quarters in 2025. A total of around 4.35 million m² was taken up in the first nine months of the year – of which 1.2 million m² or 28 per cent were owner-occupiers. The result is thus slightly above the previous year’s level of 4.34 million m². The long-term comparison, on the other hand, is more cloudy: the five-year average of the first three quarters was undercut by 20 percent and the ten-year average by 17 percent. At the same time, the number of contracts concluded fell by four percent year-on-year to 500 contracts, a minus of 14 percent compared to the corresponding five-year average (580 contracts).

Sebastian Bögel, Head of Industrial & Logistics Agency JLL Germany: “The market for warehouse and logistics space is characterized by a high level of reliability this year. At the beginning of the year, we expected an overall result above the previous year’s take-up of 5.47 million m², but below six million m². This is exactly the corridor we are in now, if the market continues on its path until the end of the year, although the economic and geopolitical challenges have not diminished, but rather increased. In this constellation, the German market plays a key role as an economic nation in the centre of Europe. The market is increasingly assuming this role, but we hope that the lack of economic growth to date will provide further impetus in order to make better use of the potential of the German market.”

Frankfurt region leads the field of five conurbations after three quarters

The five conurbations of Berlin, Düsseldorf, Frankfurt, Hamburg and Munich generated sales of around 1.31 million m² in the first nine months of the year – 21 per cent more space than in the same period last year. As in the previous year, the region with the highest take-up was Frankfurt with 364,900 m², an increase of eleven per cent year-on-year. The regions of Berlin (up 45 per cent) with 329,100 m² and Hamburg (up 65 per cent) with 284,600 m² are also up. The Munich region also recorded a positive development with 170,000 m² (plus five percent). Only the Düsseldorf region had to accept a minus of 17 percent with 159,100 m².

The greatest demand in the five regions came from companies from industry (388,100 m²) and the transport, traffic and warehousing sectors (338,500 m²). They recorded year-on-year increases of eight percent and 16 percent, respectively. Meanwhile, retail companies grew significantly by 50 percent and turned over 333,000 m². It also resulted in the largest deal to date in the five main regions: The owner-occupier Netto began construction of a 65,000 m² logistics centre in Kremmen near Berlin

Demand for large-scale space with more than 10,000 m² has increased noticeably

In the five metropolises, the number of deals in the size class from 10,000 m² has increased disproportionately. In the first three quarters, this category accounted for 31 deals with a total of 603,000 m². This corresponds to an increase of twelve transactions and 256,000 m² compared to the same period last year. Compared to the five-year average, the result is one deal and 114,000 m² below the long-term average.

From January to September, around 440,000 m² of new warehouse space was completed in Berlin, Düsseldorf, Frankfurt, Hamburg and Munich, around 200,000 m² more than in the same period last year. Compared to the five-year average, the volume is twelve percent behind. 72 percent of the space had already been rented or given to owner-occupiers before completion. At the end of September, around 550,000 m² were under construction, 43 percent of which are still unlet. The largest construction activity is currently taking place in the regions of Berlin (around 203,000 m²) and Düsseldorf (approx. 112,000 m²).

Prime rents for warehouse space of 5,000 m² or more remained unchanged in all five regions in the third quarter. In a year-on-year comparison, Frankfurt recorded an increase of 25 cents to 8.20 euros/m²/month. Munich leads the rent level with 10.70 euros/m²/month, followed by Berlin with 10.50 euros/m²/month. Düsseldorf reaches 9.00 euros/m²/month, while Hamburg is at 8.50 euros/m²/month. Over the five-year period, prime rents rose significantly in all regions – from 32 percent in Frankfurt and Hamburg to 91 percent in Berlin

Outside the five conurbations, the sales result remains below average

In the first three quarters, around 3.04 million m² were taken outside the five conurbations mentioned. The previous year’s figure of 3.26 million m² was missed by seven percent and the five-year average by as much as 23 percent. Owner-occupiers accounted for around one million m², a third of total take-up and the same amount of space as in the previous year. Compared to the five-year average, however, a minus of 23 percent is also recorded here.

Around 40 percent of the space was occupied by companies from the transport, traffic and warehousing sectors, which corresponds to an increase of eight percent compared to the previous year. Industrial companies demanded almost ten percent less space year-on-year and were responsible for a third of sales overall. Outside the five conurbations, sales by retail companies have slumped significantly (by 29 percent). In total, they account for only 20 percent of take-up.

The largest transaction in the third quarter was the acquisition by Birkenstock of an existing property of around 78,000 m² in the Dresden area for its own use. Other significant deals include the leases of around 61,500 m² by ID Logistics in Diemelstadt in Hesse and over 60,000 m² in the “Mittelweser Park” in Estorf, which were already completed in the first half of the year.

With around 397,300 m² and an increase of 35 per cent year-on-year, the Ruhr region once again recorded the highest take-up result among the regions outside the conurbations. The regions of Bremen (146,500 m²), Mönchengladbach (144,000 m²) and Kassel/Bad Hersfeld (108,100 m²) follow at a considerable distance.