According to Savills, average prime office yields in Europe compressed by 5 basis points (bps) and offices remained the most transacted sector in the region.

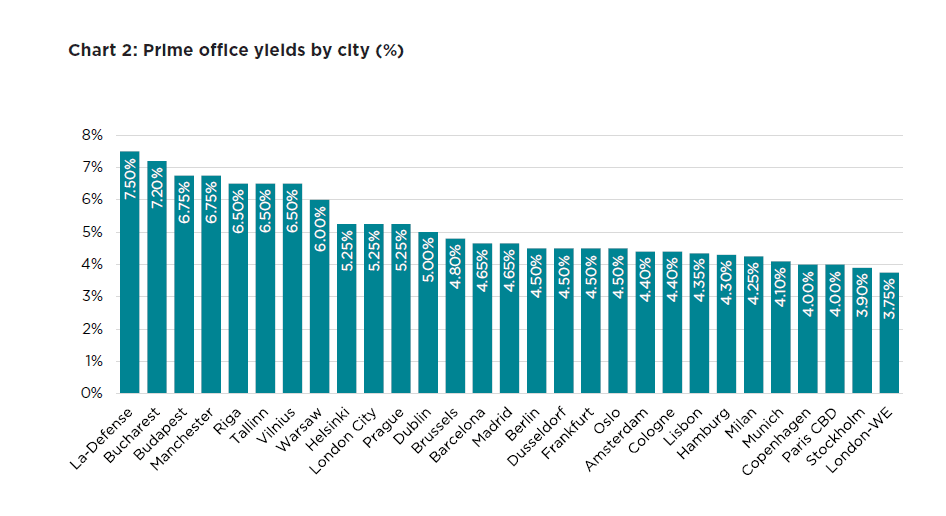

The analysis, based on RCA data, shows investors have renewed confidence in the offices sector and are seeking to take advantage of attractive pricing. During Q2 2025, European average prime office yields compressed by an average of 5 bps to 4.96%. Core Western European markets recorded the strongest yield compression, with markets including Madrid (-25 bps to 4.65%), Barcelona (-25 bps to 4.65%), Amsterdam (-20 bps to 4.40%), Munich (-10 bps to 4.10%) and Paris CBD (-25 bps to 4.00%) all registering inward movement. From a fair value perspective, Madrid and Milan are the most attractively priced European office markets, says Savills, given their strong rental prospects.

According to the international real estate advisor, capital raised for European real estate strategies in H1 2025 rose by 118% compared to H1 2024 to €34bn, as global investors seek to increase exposure to the continent, although intra-regional buyers are expected to dominate during H2 2025. Appetite for larger acquisitions is also returning, with the proportion of €200m+ lot sizes rising to 24% of total volumes in H1, up from 15% last year.

James Burke, Director, Global Cross Border Investment at Savills, says: “Entering Q3 2025, there is an acceptance among buyers and sellers that pricing levels are becoming clearer and yields are beginning to compress for prime office stock across selected European geographies. Arguably one of the biggest changes in 2025 has been the increased competitiveness amongst lenders with a renewed desire to lend against well-located office product.”

Mike Barnes, Director in Savills European Commercial Research team, adds: “From an occupational perspective – and supporting investor demand – European office markets continue to improve. Vacancy rates made their first inward movement of the cycle, and tenant demand in H1 2025 was particularly strong in Germany and London’s West End with office take up rising by 18% and 29% year-on-year respectively. The European office development pipeline is also entering a ten year low, which is supporting further rental growth and will give investors additional confidence.”

Read the full report …