By Lushan Sun and Miriam Uebel

In this blog series we summarise the key developments in private markets over 2025 and our expectation for 2026.

Strong performance over 2025

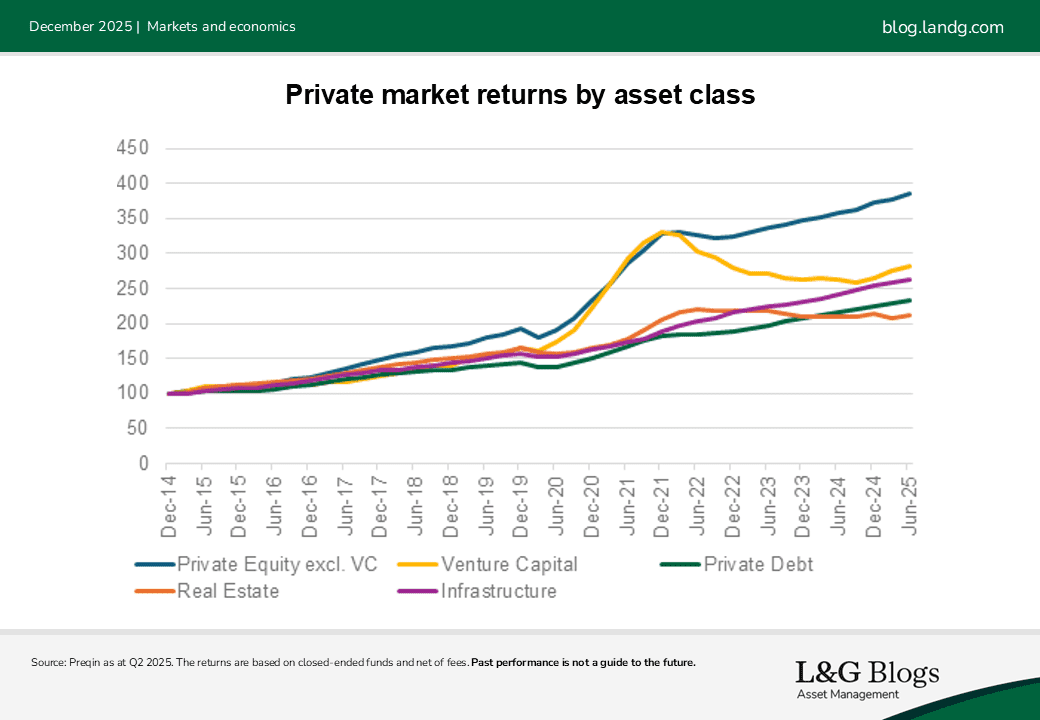

Market conditions over 2025 have largely been benign. Moderating inflation, lower policy rates, robust economic growth in the US and supportive fiscal policy in Europe helped private market asset classes deliver positive performance over the first half of 2025 (latest data available at time of writing). This is, of course, despite persistent uncertainty over tariffs.

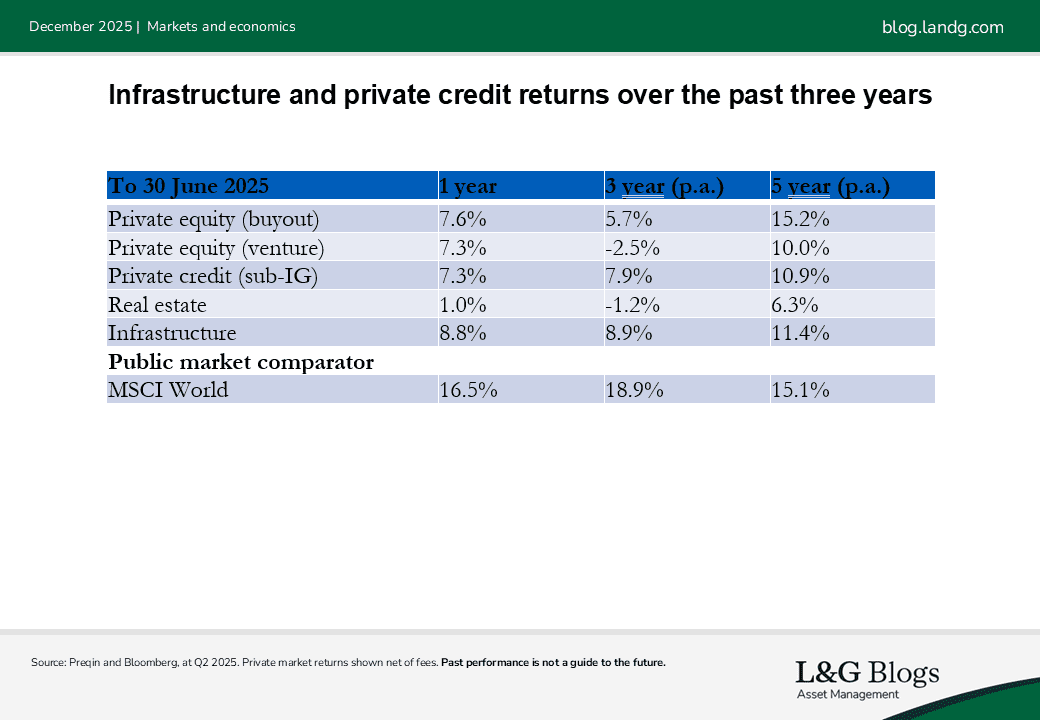

On a three-year basis, private credit and infrastructure outperformed other asset classes as returns were supported by higher rates and inflation. 2025 also marked the start of a recovery in real estate and venture capital, with these asset classes having seen a valuation reduction of 20-30% over 2022-24. Private equity buyout, on the other hand, saw less mark-to-market correction over the same period despite well-documented challenges.

Asset yield dashboard

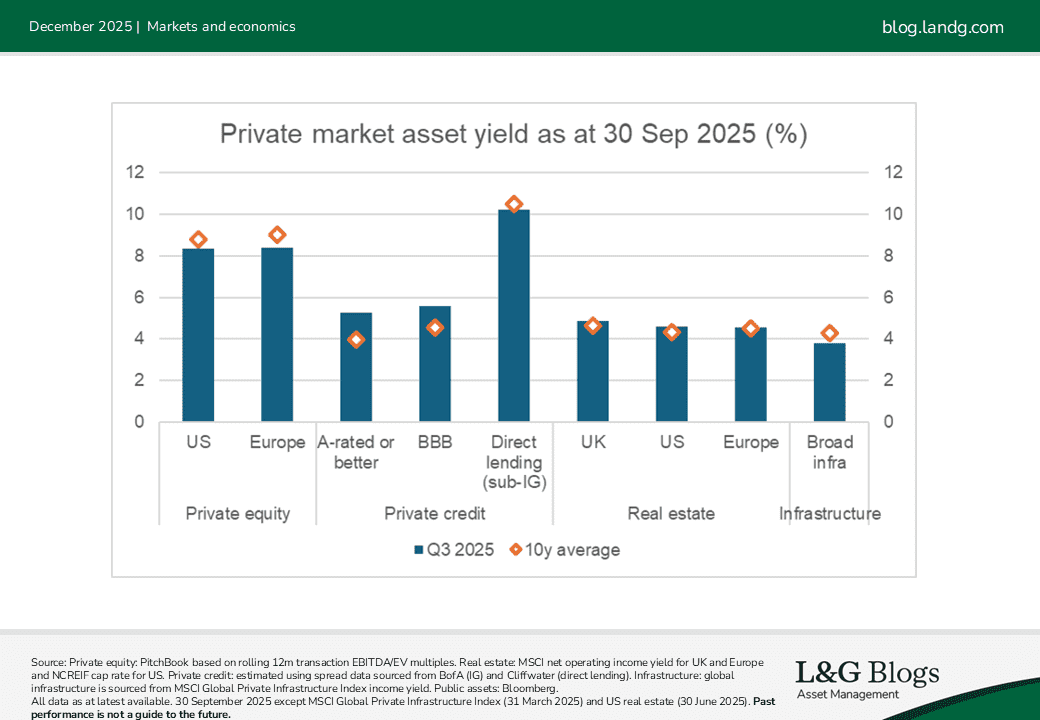

In terms of yield, sub-investment grade (sub-IG) private credit (i.e., direct lending) leads the pack at c.10%. However, intense competition versus a resurgent bank loans market means that spreads have significantly compressed and yield is now slightly below the 10-year average. In contrast, investment-grade private credit continues to price attractively relative to history due to higher rates.

Real estate (measured by net operating income yield) at 4-5% is higher than average, especially in UK and US. Broad infrastructure (measured by income yield) and private equity (measured by enterprise value/EBITDA) remain expensive relative to history, in our view.

Capital allocation improving

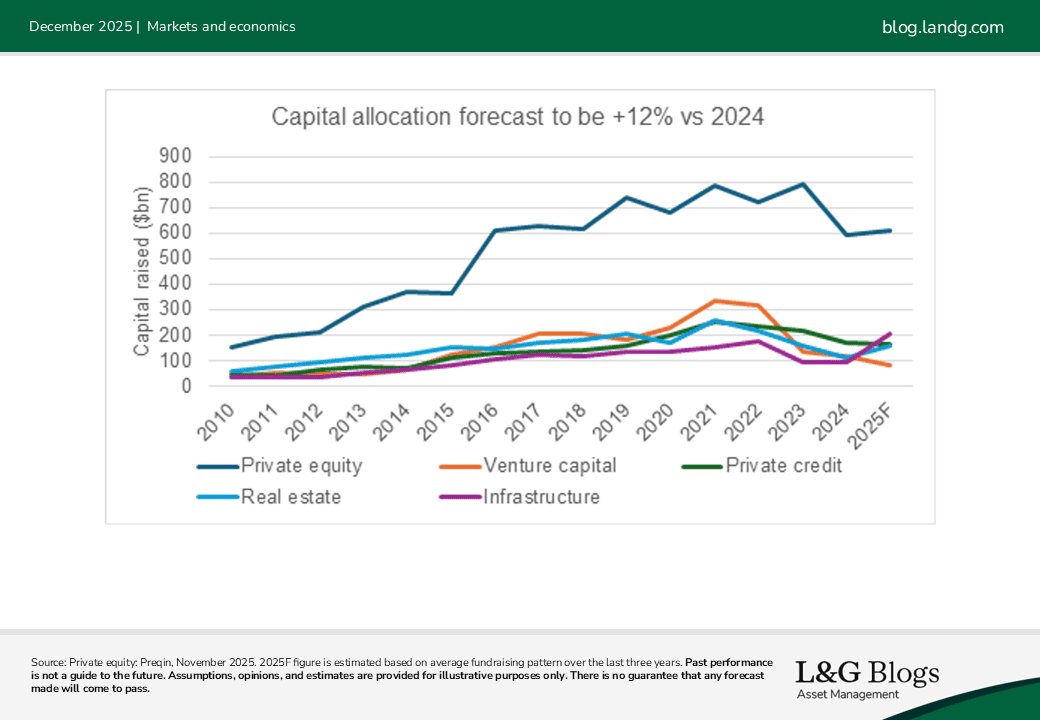

Capital raising for 2025 is forecast to be c.10% higher than 2024. Infrastructure is having a record-breaking year, driven by investor demand for digital and renewable assets. Real estate and (to a lesser extent) private equity buyout, are also recovering from a below-par 2024. We believe the low point in allocations may have passed and we can expect a stronger 2026 if current conditions persist.

Despite an increase in allocation, investors remain cautious and increasingly direct capital to megafunds. Take infrastructure for example, nearly 60% of the capital raised over the first nine months of 2025 is in funds larger than $5bn.

The rest of the blog series will delve into real estate, infrastructure, private credit and private equity in more detail.

Assumptions, opinions, and estimates are provided for illustrative purposes only. There is no guarantee that any forecasts will come to pass.

Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

More about Lushan Sun, Head of Cross-Asset Research, Private Markets, Asset Management, L&G

LGIM Blog – Lushan Sun, Private Credit Research Manager

Link zum L&G Blog