The European real estate debt market presents a compelling structural opportunity for institutional investors. Following a necessary 20% average valuation correction since 2022, the market has established a more sustainable foundation for lending, while regulatory constraints on traditional banks have created a massive refinancing opportunity through 2026. For institutions seeking yield enhancement with downside protection, this cycle offers the optimal entry point into European real estate debt strategies.

Revaluation Enhances Institutional Returns

The 20% average decline in European real estate values since 2022, with office segments down 30%, has fundamentally improved the risk-return profile for institutional debt investors. Current lending is now underwritten against realistic, stress-tested valuations rather than cycle peaks, providing enhanced downside protection for institutional capital.

This repricing has eliminated frothy valuations that characterized pre-2022 underwriting, creating a more disciplined lending environment. For institutional investors, this means accessing real estate debt exposure at the most attractive entry point in over a decade, with loan-to-value ratios averaging 65%-70% against rebased asset values, a meaningful improvement from historical 80-85% leverage ratios.

Regulatory Environment Creates Institutional Opportunity

The implementation of CRR III in January 2025 has fundamentally altered the competitive landscape in favor of institutional debt providers. Tightened capital requirements for banks, particularly on commercial real estate exposures, have reduced traditional lending capacity by an estimated 25-30% across major European markets. This regulatory shift creates a structural advantage for institutional debt funds, which face no such capital constraints. In Germany alone, BaFin estimates EUR 100bn of commercial real estate loans require refinancing through 2026 – representing approximately 10% of the total market that banks cannot adequately serve under current regulatory frameworks.

For institutional investors, this represents a multi-year opportunity to capture market share in a supply-constrained lending environment, with the ability to command premium pricing for flexible, non-bank capital solutions.

Alternative Capital Steps In

This combination of rebased valuations, regulatory headwinds for banks and a looming refinancing wall has created fertile ground for non-bank lenders. Debt funds are stepping in with solutions that combine speed, flexibility, and structuring expertise.

Unlike banks, they can offer tailored financing solutions to complex situations – whether that means bridging to a sale, funding ESG-Capex, or providing higher advance rates within a disciplined risk framework.

Whole loans have become a preferred tool in this environment. By combining senior security with slightly higher LTVs than banks, they allow sponsors to close funding gaps without resorting to junior debt. Typical structures include first-ranking mortgages, interest reserves and covenants linked to cash flow and capex milestones. Junior financing, while less prominent today, remains relevant for recapitalizations and complex capital stacks and could regain importance as transaction activity accelerates.

Sector Fundamentals Still Matter

Institutional deployment strategies must balance sector fundamentals with competitive dynamics to optimize risk-adjusted returns. While residential and logistics offer the strongest structural drivers, such as France’s annual housing shortfall of over 500,000 units and sub-3% logistics vacancy rates in European prime hubs, these sectors attract intense competition, with 4-6 lenders bidding on quality transactions and compressing margins.

Superior returns emerge in less competitive segments where the flexibility of alternative lenders commands premiums. For example Dutch office assets with AAA-rated government tenants or long-term public sector leases offer defensive characteristics with reduced lender competition. Similarly, modern ESG-compliant office buildings in core business districts command 15-20% rent premiums while accessing dedicated sustainability-focused capital pools, creating opportunities for lenders with ESG expertise.

Value-add strategies present particularly attractive opportunities for debt funds, combining immediate cash flow from stabilized portions with higher yields on the repositioning elements. Assets requiring modest capex improvements – lease-up, light refurbishment, or ESG upgrades – typically generate current yields of 6-8% while offering total returns of 9-10%, providing downside protection through existing income streams while capturing upside from value creation.

Special situations including refinancing distress from equity fund pressure typically yield 200-300 basis point premiums at conservative 60-65% LTVs, while mixed-use assets (office-residential, retail-logistics combinations) see reduced competition enabling 100-150 basis point margin enhancement.

Optimal institutional allocation strategies combine defensive residential and logistics exposure with selective investments in government- or corporate-tenanted office assets, mixed-use assets, value-add opportunities, and higher-yielding special situations, providing geographic diversification while capturing structural market dislocations that favor sophisticated, flexible capital providers.

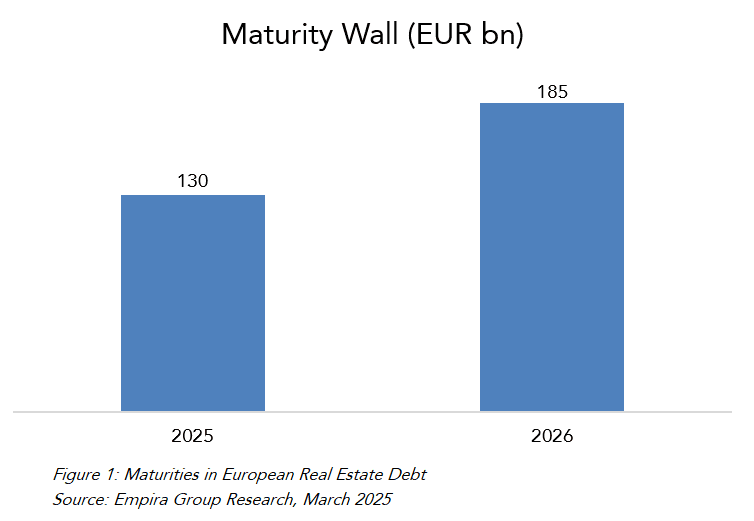

EUR 315bn Refinancing Pipeline Creates Deployment Opportunity

The approaching refinancing wave represents the largest institutional deployment opportunity in European real estate debt since 2008. In 2025 alone, EUR 130bn of real estate debt matures and must be refinanced. Further EUR 185bn will mature in 2026. Many of these loans originated at sub-3% rates against higher valuations, creating funding gaps that traditional banks cannot bridge under current constraints.

The mandatory building upgrades under the EU’s recast Energy Performance of Buildings Directive create additional specialized financing demand. The directive requires all residential buildings to achieve minimum Class E energy performance by 2030 and Class D by 2033, with commercial buildings facing similar timelines.

Properties currently rated F or G – representing approximately 15% of Europe’s commercial building stock – face potential obsolescence without substantial energy efficiency investments including insulation, HVAC modernization, and renewable energy installations. This regulatory mandate generates EUR 50-75bn in capex financing requirements through 2033, creating opportunities for lenders capable of structuring milestone-based facilities tied to energy performance improvements.

For institutional investors, this pipeline provides visibility into sustained deployment opportunities over a 4-6-year horizon, enabling strategic capital allocation planning while supporting portfolio construction across vintage years and economic cycles.

What Lies Ahead

The outlook for the second half of 2025 is cautiously optimistic. If the ECB continues its gradual easing path, base rates will drift lower, but spreads should remain sufficiently wide to preserve attractive risk-adjusted returns for private credit strategies. Transaction volumes are expected to improve further, aiding valuation clarity and exit options. Sector bifurcation will persist, reinforcing the need for granular underwriting and disciplined structuring.

For institutional investors, the case for European real estate debt is compelling. It offers income stability, capital preservation, and diversification at a time when traditional fixed income remains volatile.